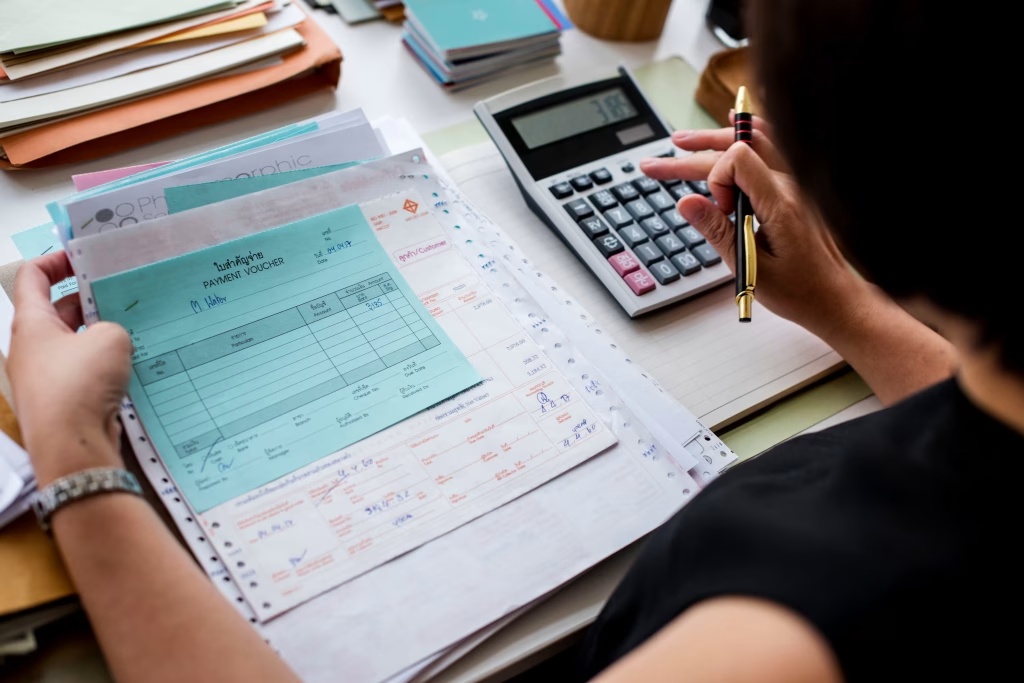

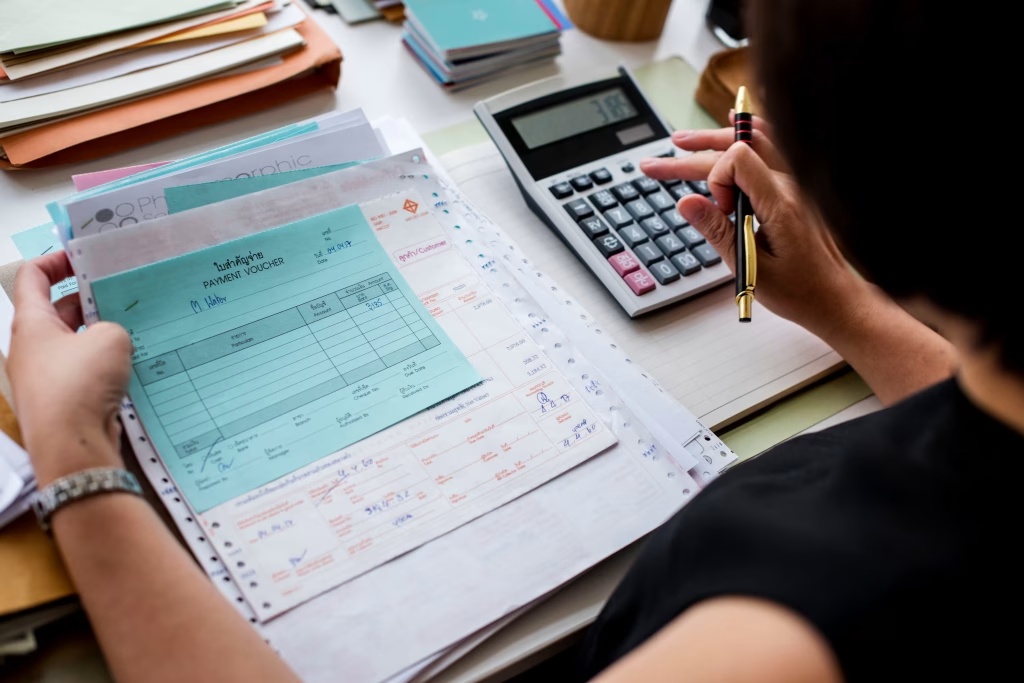

Modern Accounting for Ambitious Businesses

From cloud bookkeeping to R&D tax credits — we simplify compliance, boost efficiency, and support your growth.

We offer a full range of accounting

services for your business.

Bookkeeping

- Accurate, timely bookkeeping that ensures compliance and provides clear financial insights.

- Cloud-based solutions like Xero, QuickBooks, and FreeAgent for real-time management.

- Reduce admin workload and improve financial accuracy.

Statutory Accounts Preparation

- Comprehensive payroll management, including payslips, PAYE, and National Insurance.

- Accurate, HMRC-compliant service for businesses of all sizes.

Tax Planning and Compliance

- Strategic planning for corporation tax, VAT, and personal tax to reduce liabilities legally and efficiently.

- Services include VAT returns, self-assessments, and capital gains tax planning.

- Proactive approach ensures compliance with evolving tax laws and maximizes savings.

Payroll Services

- Comprehensive payroll management, including payslips, PAYE, and National Insurance.

- Accurate, HMRC-compliant service for businesses of all sizes.

Company Secretarial Services

- Support with company formation, statutory filings, and compliance with Companies House.

- Ideal for startups and small businesses needing administrative assistance.

Specialized Services By Houle Accounting Experts

Research and Development (R&D) Tax Credits

- Expert support for claiming R&D tax credits under HMRC’s SME and RDEC schemes.

- Identify qualifying innovation, calculate eligible costs, and ensure compliant documentation.

- Maximize benefits — up to 27% cash credit for R&D-intensive SMEs.

Corporate Finance & Business Advisory

- Strategic advice on growth, forecasting, cash flow, and funding.

- Support for restructuring and investment planning.

Audit & Assurance Services

- Conduct statutory audits to ensure accuracy and regulatory compliance.

- Assurance services to build stakeholder trust and confidence.

Making Tax Digital (MTD) Compliance

- Help businesses comply with HMRC’s digital tax rules.

- Integrated solutions for VAT and income tax via cloud accounting.

Sector-Specific Accounting

- Tailored accounting for property, healthcare, and e-commerce businesses.

- Industry-specific insight for accurate, relevant financial support.

Additional Value-Added Services

Business Startup Support

- Guidance on company formation, business plans, and tax setup.

- Support for R&D claims on pre-trading expenditure.

Inheritance Tax & Trust Planning

- Ideal for high-net-worth individuals.

- Plan for the future with expert inheritance tax strategies and trust setup.

HMRC Enquiry Defence

- Support during HMRC investigations, especially for complex R&D claims

- Protect your business with expert guidance.

Capital Allowances & Tax Incentives

- Maximize tax reliefs on equipment, property, and intellectual property.

- Includes Patent Box and other incentives.

Trusted more than 100+ companies

25 Years trusted by worldwide companies

With over 25 years of experience, Houle is a trusted UK-based accountancy firm dedicated to helping businesses and individuals thrive. From cloud bookkeeping to complex R&D tax relief claims, we combine traditional reliability with modern solutions.

“Accounting isn’t just about numbers — it’s about clarity, strategy, and growth”

― Houle

Let the numbers speak

0

+

Businesses

0

+

Happy Clients

0

+

Years Experience

0

+

Team

Houle transformed the way we manage our finances. From R&D tax credits to everyday bookkeeping, their team is proactive, responsive, and incredibly knowledgeable. We've saved time, reduced our tax liabilities, and gained real financial clarity.

Kim Wexler

Business Owner

Get Started with us today

Connect with us for your business accounting services

+1 234 5678

Call us right now