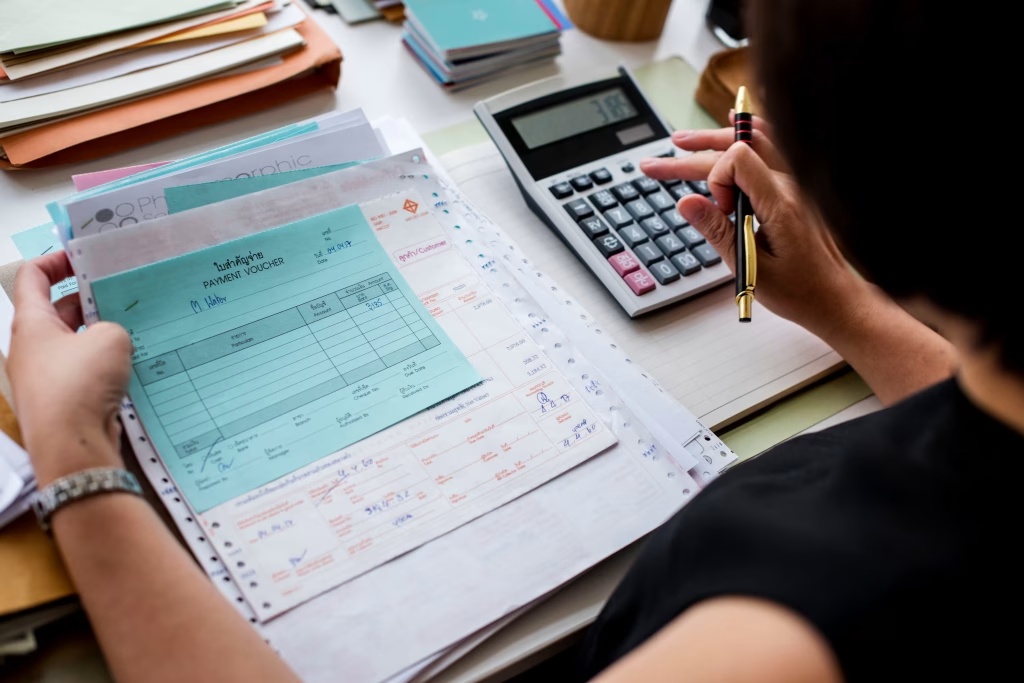

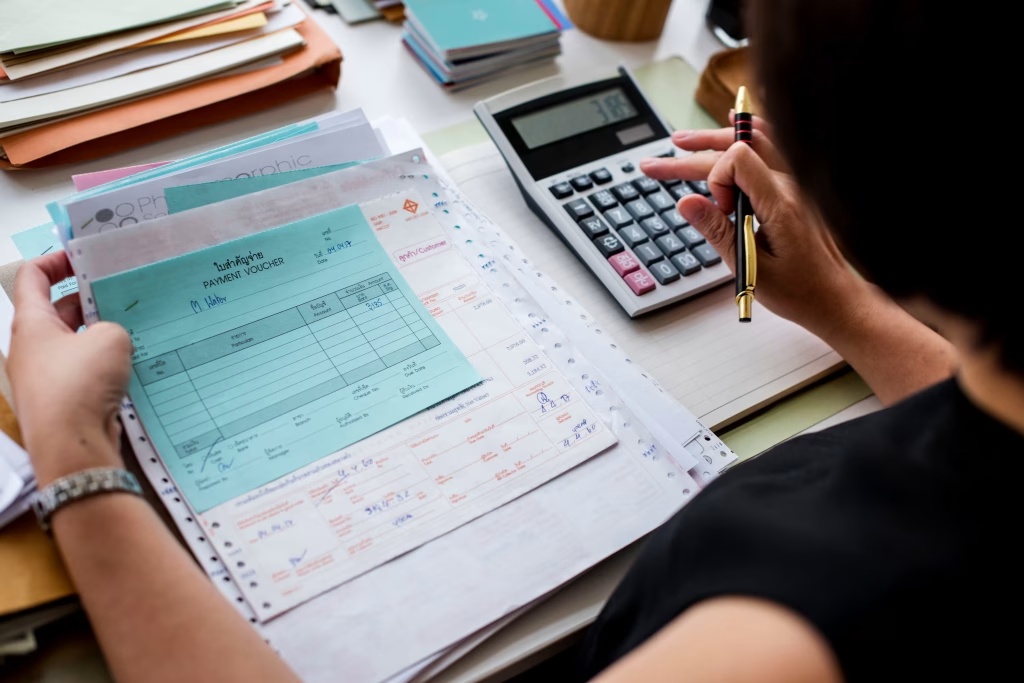

Modern Accounting for Ambitious Businesses & Individuals

From cloud bookkeeping to R&D tax credits — we simplify compliance, boost efficiency, and support your growth.

We offer a full range of accounting

services for your business.

Bookkeeping

- Accurate, timely bookkeeping that ensures compliance and provides clear financial insights.

- Cloud-based solutions like Xero, QuickBooks, and FreeAgent for real-time management.

- Reduce admin workload and improve financial accuracy.

Payroll services

- Reliable, on-time payroll processing for employees and contractors.

- Full compliance with HMRC regulations, including RTI submissions.

- Automated payslips, tax calculations, and pension contributions.

Year End Accounts

- Preparation and submission of statutory annual accounts.

- Ensure Companies House and HMRC compliance.

- Clear reporting to support future financial planning.

Company Formation

- Complete company registration with Companies House.

- Guidance on choosing the right structure (Ltd, LLP, etc.).

- Help setting up business bank accounts, HMRC registration, and more.

Individual tax returns

- Self-assessment filing with all applicable tax reliefs and deductions.

- HMRC compliance and deadline management.

- Personalised advice for sole traders, landlords, and high earners.

VAT Returns

- Timely and accurate VAT calculations and submissions.

- Support for Flat Rate, Standard, or Cash Accounting schemes.

- Ensure compliance and avoid HMRC penalties.

Company Accounts & CT600

- Complete preparation of statutory accounts and CT600 tax returns.

- Corporation tax calculation and submission to HMRC.

- Ongoing compliance and tax-saving strategies.

Management Account Reports

- Monthly or quarterly financial reports for business decision-making.

- Breakdown of KPIs, profit & loss, and cash flow insights.

- Tailored advice based on your company’s performance data.

Specialized Services By Houle Accounting Experts

Research and Development (R&D) Tax Credits

- Expert support for claiming R&D tax credits under HMRC’s SME and RDEC schemes.

- Identify qualifying innovation, calculate eligible costs, and ensure compliant documentation.

- Maximize benefits — up to 27% cash credit for R&D-intensive SMEs.

Corporate Finance & Business Advisory

- Strategic advice on growth, forecasting, cash flow, and funding.

- Support for restructuring and investment planning.

Making Tax Digital (MTD) Compliance

- Help businesses comply with HMRC’s digital tax rules.

- Integrated solutions for VAT and income tax via cloud accounting.

Sector-Specific Accounting

- Tailored accounting for property, healthcare, and e-commerce businesses.

- Industry-specific insight for accurate, relevant financial support.

Additional Value-Added Services

Business Startup Support

- Guidance on company formation, business plans, and tax setup.

- Support for R&D claims on pre-trading expenditure.

HMRC Enquiry Defence

- Support during HMRC investigations, especially for complex R&D claims

- Protect your business with expert guidance.

Capital Allowances & Tax Incentives

- Maximize tax reliefs on equipment, property, and intellectual property.

- Includes Patent Box and other incentives.

Trusted more than 100+ companies

25 Years trusted by worldwide companies

With over 25 years of experience, Houle is a trusted UK-based accountancy firm dedicated to helping businesses and individuals thrive. From cloud bookkeeping to complex R&D tax relief claims, we combine traditional reliability with modern solutions.

“Accounting isn’t just about numbers — it’s about clarity, strategy, and growth”

― Houle

Let the numbers speak

0

+

Businesses

0

+

Happy Clients

0

+

Years Experience

0

+

Team

Houle transformed the way we manage our finances. From R&D tax credits to everyday bookkeeping, their team is proactive, responsive, and incredibly knowledgeable. We've saved time, reduced our tax liabilities, and gained real financial clarity.

Kim Wexler

Business Owner

Get Started with us today

Connect with us for your business accounting services

Call us right now